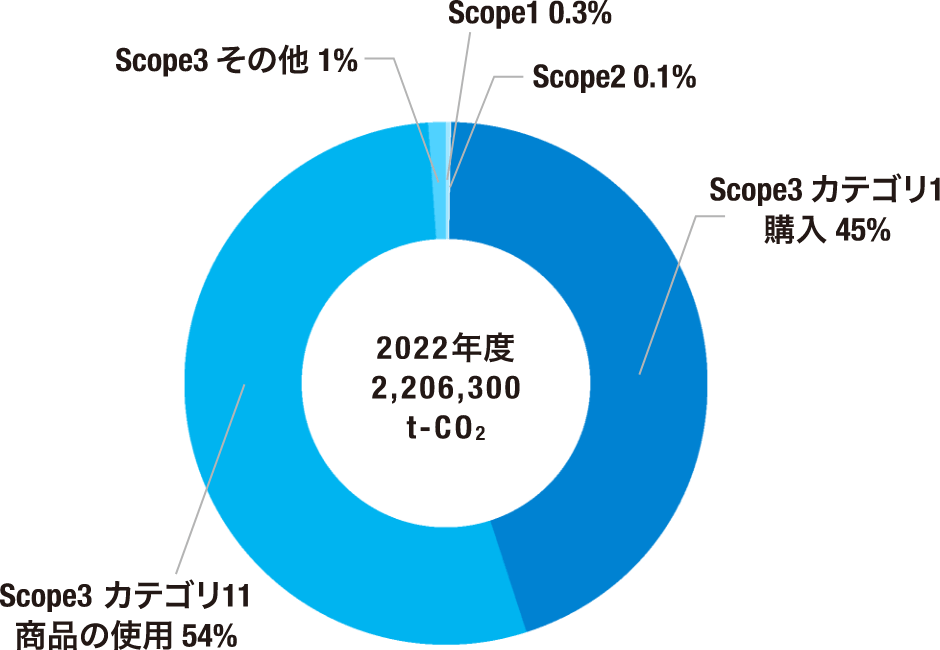

<2023年度温室効果ガス排出量(Scope1-3)>

| Scope | Scope3カテゴリー | 排出量(t-CO2) |

|---|---|---|

| Scope1+2 合計 | 10,133 | |

| Scope1 | 7,124 | |

| Scope2 | 3,009 | |

| Scope3 | 1 購入 | 1,380,365 |

| 2 資本財 | 4,837 | |

| 3 その他燃料 | 2,034 | |

| 4 輸送(上流) | 1,666 | |

| 5 廃棄物 | 143 | |

| 6 従業員の出張 | 441 | |

| 7 従業員の通勤 | 1,044 | |

| 11 商品の使用 | 213,174 | |

| 12 商品の廃棄 | 81 | |

| Scope3 合計 | 1,603,786 | |

| 合計 | 1,613,919 | |

<2023年度の温室効果ガス排出量(Scope1-3)の算定結果>

※Scope3 8 リース資産(上流)、9 輸送(下流)、10 商品の加工、13 リース資産(下流)、14 フランチャイズ、15 投資は当社の事業と関連性がないため、算定対象外としております。

※Scope3 11 商品の使用、12 商品の廃棄は、協和医科器械(株)、(株)栗原医療器械店、(株)アルバース、(株)秋田医科器械店、佐野器械(株)の5社を算定対象としております。